Contents

- What are the Tax benefits of having a life partner after marriage?

- A. Child Education Fees under section 80C (Tax planning after marriage)

- B. Home loan interest and Principal

- (Tax planning after marriage)

- C. Mediclaim Premium under Section 80D

- (Tax planning after marriage)

- D. LTCG under Section 112A

- (Tax planning after marriage)

- E. By opening HUF

- (Tax planning after marriage)

- F. Money given to spouse

- (Tax planning after marriage)

- G. Start a new business in your wife’s name

- (Tax planning after marriage)

What are the Tax benefits of having a life partner after marriage?

A Life Partner is a partner in everything you do. Apart from many emotional and physical needs, having a life partner can also help you in saving lot of taxes under Income Tax in india. In the article below, we have tried our best to give you a glimpse / hint about how to do tax planning after marriage. Hope you find it useful.

A. Child Education Fees under section 80C (Tax planning after marriage)

An individual can claim deduction for full time education of their children under section 80C.

The deduction is allowed for the amount of “Tuition Fees” only as shown in the fees receipt issued by educational institutions.

Tuition fees deduction is allowed for “any 2 children” of an individual.

If you have more than 2 children then you can claim deduction for third or more child in your partner’s ITR.

For example: If a couple has 4 children then both the parent can claim deduction of Tuition fees for any 2 children each.

B. Home loan interest and Principal

(Tax planning after marriage)

If an individual has taken home loan, then the Principal amount can be claimed as deduction under section 80C upto 1.5lakhs.

If the principal amount is more than 1.5Lakhs and home loan is taken as co-borrowers by both the individual then the deduction can claimed by both the individual in their ITR.

C. Mediclaim Premium under Section 80D

(Tax planning after marriage)

Under section 80D, a person can claim deduction on the premium paid for Health insurance.

The health insurance can be for self, spouse, children, parents.

If you purchase health insurance for self and spouse, then you can claim tax deduction for the premium paid upto Rs 25,000.

If you or your spouse age is above 60, then you claim deduction upto Rs 50,000.

D. LTCG under Section 112A

(Tax planning after marriage)

As per Section 112A, a person can claim exemption upto Rs 1 lakh on long term capital gain arising on the sale of listed equity shares or equity oriented mutual funds or the units of business trust, provided Security Transaction Tax (STT) has been paid.

10% tax rate is applicable for the gains exceeding Rs 1 lakh.

Since this exemption can be availed by each tax payer, the investments can be made in the name of spouse also, so as to be able to avail the benefit of this exemption every year as long as it is possible to claim.

E. By opening HUF

(Tax planning after marriage)

Income Tax Act treats HUF as an individual Assessee.

Tax on the taxable income of HUF is applicable as per Slab Rates which are applicable on an individual also.

So if an individual is having income from ancestral property then he should create HUF with the help of his spouse. And then treat that property as a property of HUF.

In this way income from that ancestral property will become income of HUF and tax as per Slab rate will be applicable on that income.

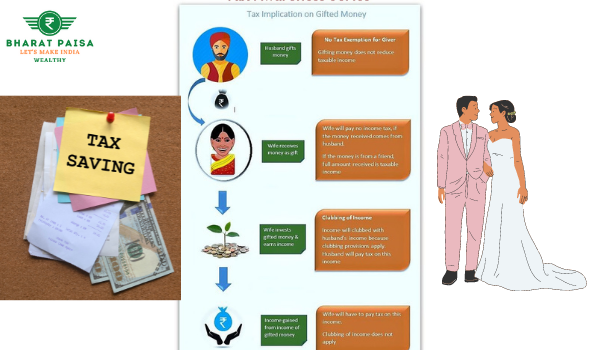

F. Money given to spouse

(Tax planning after marriage)

If money is given to spouse for her personal household expenses then that money will not be clubbed with the income of husband. Clubbing provisions will not apply.

If money is gifted to wife and invested in FD, then FD interest received in first year will be clubbed with the husband income.

If the wife further reinvest the interest income received from FD then no clubbing provision shall apply.

G. Start a new business in your wife’s name

(Tax planning after marriage)

The amount given to wife will be given in the form of loan/Gift.

Clubbing provision shall be applicable only if the gifted money is included in the capital of business on the first day of Financial Year.

If the gifted money is not included in the capital of business on first day of F.Y., then the entire profit from the business will be taxable in the hands of wife only.

Thanks for reading this article. Hope you found it very insightful and eye opener.

For more such blogs, visit Bharatpaisa.com

Please comment your questions and feedback below.