Contents

What is Capital Adequacy Ratio

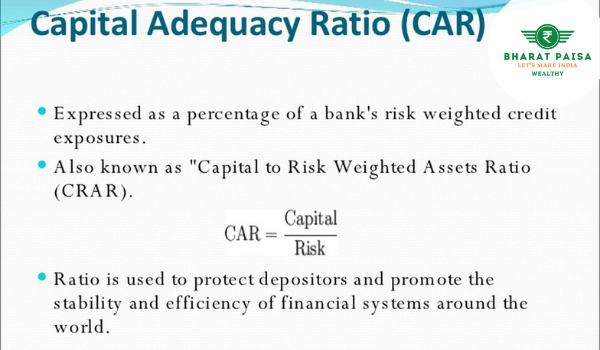

Generally, the capital adequacy ratio is used for the financial strength measurement of the bank by using its capital and assets. The capital adequacy ratio is also well known as the capital to risk-weighted assets ratio.

The capital adequacy ratio is used not only to protect the depositors but also to increase the efficiency and stability of the banking system in the country. It shows the availability of capital to the bank. CAR also defines the details related to the risk-weighted credit exposures percentage of the bank.

How to Calculate CAR?

Formula of Capital Adequacy Ratio

| CAR ratio = (tier 1 capital + tier 2 capital) / risk-weighted assets |

For understanding the CAR formula, you must know the below-mentioned terms:

- Tier 1 capital

- Tier 2 capital

- Risk-weighted assets

Tier 1 capital

Tier 1 capital is the easiest solution to cover the losses. Tier 1 capital is also known as Core capital because it is the best source to absorb the losses without hampering operations. It comprises equity capital, intangible assets, and audited revenue reserves

Tier 2 capital

Tier 2 capital comprises the retained earnings, profit and loss, and reserves. Tier 2 capital is the last resort for the Bank at the time of liquidation and winding up to cover up the losses.

Risk-weighted assets

For measuring the minimum capital amount held by institutions and banks to minimize the insolvency risk, the risk-weighted assets are used. For any type of bank asset, generally, the capital requirement is based on the risk assessment.

Importance of capital adequacy ratio

Below, we have tried to explain you with how this CAR turns out to be so important.

1. Stability and efficiency of the financial system

The capital adequacy ratios ensure the stability and efficiency of a nation’s financial system by minimizing the risk of banks becoming bankrupt. A high CAR depicts that the bank is capable to meet all the liabilities and likely to meet its financial tasks.

2. The protection of depositor’s assets

At the time of liquidation or winding up of the bank then preference is given to the funds belonging to the depositors over the capital (equity holders) of the bank. So, any depositor can only lose his savings if the bank registers the loss exceeding more than the capital amount it possesses. Thus as the bank’s capital adequacy ratio increases, the degree of depositor’s assets protection also increases.

Example – Capital Adequacy Ratio

For instance, a particular bank has 20 million rupees in tier- 1 capital and 10 million rupees in tier-2 capital, and its risk weightage asset like loans is 40 million rupees. So, the adequacy ratio for that particular bank would be,

= (20+10)/40

= 30/40

= 0.75%

Thanks for reading this article. Hope you found it very insightful and eye opener.

For more such blogs, visit Bharatpaisa.com

Please comment your questions and feedback below.