Comparing FD vs Mutual Fund is a difficult task but worth the pain. It’s going to be an eye-opener for you, so read it carefully till the last. Fixed Deposits are one of the oldest instruments of investment in India while Mutual Funds were introduced in India after 1991. People of India still hold majority of their investments in Fixed Deposits but this scenario is rapidly changing. But WHY??

Let’s understand WHY are Mutual Funds getting more popular in India?

Contents

What Is A Fixed Deposit?

A fixed deposit scheme is a market-independent investment in which you invest your money for a set period at a fixed interest rate. A Fixed Deposit is not highly rewarding in case you make premature withdrawal i.e. the Banks / PO charge a small penalty from the interest you have earned. To earn the maximum amount of interest, you must maintain your money in the FD program for the specified amount of time.

What Are Mutual Funds?

Mutual funds are a collection of stocks (equity, bonds, government deposits, and other institutional financial assets. Investors’ main money is gathered and routed into various types of security instruments through mutual funds. Mutual funds have a lot of liquidity. As a result, investors can withdraw their funds at any moment.

For easier understanding, consider Mutual Funds as an Index Fund like Sensex and Nifty, but managed and run by Asset Management Companies (AMCs), whose allocation may change every day.

FD vs Mutual Fund returns

Fixed Deposit

When you begin investing in a fixed deposit program, you will be able to predict how much money you will get after the term. Although the Banks and Financial institutions keep changing their Interest rates on FDs across different period of time. But once a FD has been booked for a particular period of time at a fixed interest rate, it’s interest rate will not change till maturity even if there is a change or revision of Interest rates by Banks.

The change in FD interest rates gets influenced by several factors, including the repo rate, which is now at 4%. However, if you have previously locked in a rate for your investment, this does not affect your income. Knowledge Fact – Interest rates on Fixed Deposits is inversely related to country’s development i.e. as a country develops, the interest rates in that country falls. For Eg – the FD interest rates in India has declined significantly from 14.50% in August 2000 to 4.5% in March 2022.

Mutual Funds

When it comes to mutual funds, the rate of return is determined by market fluctuations and the performance of your underlying assets. As a result, mutual fund returns are less guaranteed, and as an investor, you can take on varying amounts of risk depending on your asset allocation. For example, the Large Cap or Bluechip Mutual Funds have yielded a CAGR of more than 12% over last 10 years.

FD vs Mutual Fund – taxation

How good a financial product gets determined by its rate of return, but the true return on an investment is the money received after taxes have been deducted from the total amount.

In the case of a bank FD, the tax rate gets determined by your income bracket. If your taxable income is less than Rs. 10 Lakhs, you will have to pay a 20% tax on your FD returns. Similarly, if you’re in the 30% tax rate, you’ll pay 30%.

Taxation of returns on Mutual Funds can be understood from the following table

| Particulars | Equity Mutual Funds | Debt Mutual Funds | ||

| Determine Long Term or Short Term | Long Term | Short Term | Long Term | Short Term |

| Holding Period | More than 12 months | Less than 12 months | More than 36 months | Less than 36 months |

| Tax Rate | Exempt upto Rs. 1 Lakh per FY; After this Tax Rate 10% (without indexation) | STCG Tax Rate is 15% | LTCG @ 20% (with indexation benefit) | STCG @ slab rate (10%, 20%, 30%, whichever is your category) |

Interesting Fact:

In FDs, the taxes will be levied on the interest earned at the end of every FY. However, in mutual funds the tax will be charged at the time of redemption.

FD vs Mutual Fund – risk analysis

The safety of the money is one of the primary criteria for every financial venture.

One of the major perks of FDs is the assured safety aspect, but that was before the PMC bank fraud became public. In the event of a bank default, you would only receive the insured amount, which is up to Rs 5 lakh. This insurance / assurance is offered by RBI to the depositors of the Bank (both Public and Private banks) to the tune of Rs. 5 Lakhs through DICGC – Deposit Insurance and Credit Guarantee Corporation.

As per the RBI rule of 2017, all banks now stamp the relevant information regarding the Rs 5 lakh sum insured on the depositor’s passbook. So even if the bank fails, you’ll receive the insured amount.

There is no fixed return in mutual funds, there is a good chance of losing your money in the short term, but in long term, mutual funds are mostly beneficial.

FD vs Mutual Fund – lock in period

In most of the Mutual Funds, there is no lock-in period except for ELSS Mutual Funds, you can withdraw your money any time you wish to.

If you redeem an FD before its maturity time, you must pay a penalty. For example, if you cash out a five-year Bank FD in the third year, you will receive a return equal to the interest rate on a three-year FD. In addition, the penalty will get deducted from the total amount.

FD vs Mutual Fund – compounding effect

Time is your biggest ally when it comes to harnessing the power of compounding. Long-term investing alternatives allow you to take advantage of compounding’s full potential.

In Fixed Deposits, there is no compounding if you withdraw your interest on FD periodically however you can avail the benefit of compounding, if you invest in cumulative FDs i.e. you do not withdraw interest on FD before maturity. In Mutual Funds there is no concept of lock in period ( except ELSS). However, if you invest in Mutual funds for longer duration then you can enjoy the benefits of Compounding.

How FD Eats Your Money With Inflation?

You must be extremely pleased with yourself for investing in a bank fixed deposit (FD), believing that your money is safe and that you will receive a good return when it matures. To evaluate real profits on maturity, verify whether the maturity amount after taxes has outperformed the growing price level.

There will be a real gain if the after-tax rate of return is higher than inflation rate over the investment term; otherwise, the money invested will lose buying power at maturity.

For instance, if the inflation throughout a 5-year investment period is 5%, the after-tax maturity value of Rs 1 lakh after 5 years would be Rs 1,27,628. Your bank FD should earn at least this amount on maturity after tax so that you do not end up poorer by investing in the FD.

FD vs Mutual Fund conclusion

Mutual Funds have the potential to outperform FDs in the long run. Furthermore, when compared to the benefits of fixed-income investment, mutual funds are extremely liquid and tax efficient As a result of the aforementioned criteria, mutual funds are a superior investment alternative to FDs.

Ideally, you shouldn’t put more than 20% of your money into a single mutual fund. When it comes to the number of mutual funds, you should aim for less than ten. Having additional schemes in your portfolio isn’t a bad thing, but it might lead to overlap.

Fixed deposits should not even be an option unless you want to balance the risk in your portfolio and you want to take no risk.

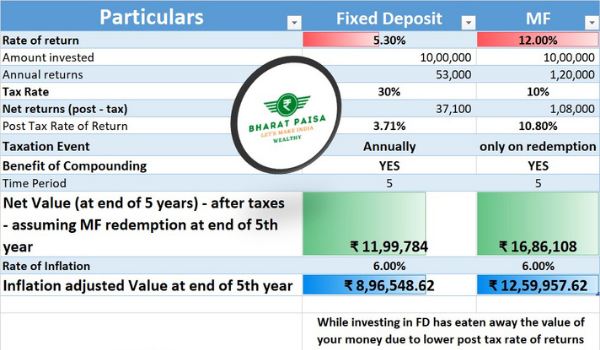

Let’s Understand the difference between Investing in FD vs. Mutual Fund – through a numerical example:

So, its crystal clear if you are really making any money or returns on FD in the current scenario.

So, for retirement planning, always opt for Mutual Funds – to beat down inflation.

Key Take away from this article

The only way to at least preserve the value of your money is to make investments where post tax rate of returns are higher than Inflation.

Thanks for reading this article. Hope you found it very insightful and eye opener.

For more such blogs, visit Bharatpaisa.com

Please comment your questions and feedback below. Also share this content with people, who think FD is the best investment they can make.