Contents

- Comparison between Unit-linked Insurance Plan (ULIP) vs Mutual Fund vs Traditional Insurance

- ULIP vs Mutual Funds – Similarities

- ULIP vs. Traditional Insurance Plan – similarities

- Here is a comparison of Unit-linked plans (ULIP) vs Mutual Fund vs Traditional Insurance plans

- Parameters

- ULIP

- Mutual Fund

- Traditional Insurance

- Purpose ULIP vs Mutual Funds vs Traditional Life Insurance

- Regulatory Body ULIP vs Mutual Funds vs Traditional Life Insurance

- Return on Investment ULIP vs Mutual Funds vs Traditional Life Insurance

- When should you Consider ULIP vs Mutual Funds vs Traditional Life Insurance

- How your money is utilized ULIP vs Mutual Funds vs Traditional Life Insurance

- Flexibility ULIP vs Mutual Funds vs Traditional Life Insurance

- Tax Benefits in investment ULIP vs Mutual Funds vs Traditional Life Insurance

- Tax Benefits on Returns ULIP vs Mutual Funds vs Traditional Life Insurance

- Expense ULIP vs Mutual Funds vs Traditional Life Insurance

- Investment Portfolio ULIP vs Mutual Funds vs Traditional Life Insurance

- The Lock-in period ULIP vs Mutual Funds vs Traditional Life Insurance

- Security ULIP vs Mutual Funds vs Traditional Life Insurance

- Switching options ULIP vs Mutual Funds vs Traditional Life Insurance

- Ideal term ULIP vs Mutual Funds vs Traditional Life Insurance

Comparison between Unit-linked Insurance Plan (ULIP) vs Mutual Fund vs Traditional Insurance

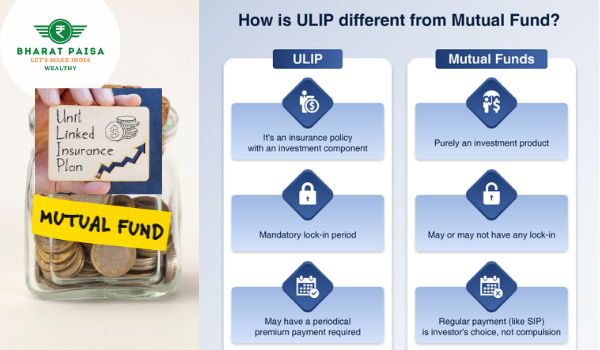

Unit Linked Insurance Plan (ULIP) is a type of hybrid insurance plan that provides both insurance coverage and investment in a single plan. Mutual Funds on the other hand is a type of investment instrument, where an enormous number of individuals pool their money that is invested in stocks, bonds, equities, etc. in order to earn good returns. For better ULIP vs Mutual Funds comparison, let’s go deeper.

ULIP vs Mutual Funds – Similarities

The portfolio managers of both Equity ULIPs and equity Mutual Fund both invest their money in stocks. Consequently, the returns on both ULIP and Mutual Funds are dependent on the stock market. Both the instruments are subject to market risk and in the long run yields high return.

ULIP vs. Traditional Insurance Plan – similarities

Both the plans provide life coverage to an individual. A certain portion of the premium paid in ULIP is utilized for providing life coverage. Like a Traditional Insurance plan, ULIP encompasses the tax benefits. The major part of the fund is invested in debt instruments which makes it the most stable and risk-free investment. The return provided in the event of the death of the policyholder is the sum assured along with the ensured bonus. The premiums in traditional premium plans and ULIPs are fixed and withdrawals will not be permitted before the maturity of the plan.

Here is a comparison of Unit-linked plans (ULIP) vs Mutual Fund vs Traditional Insurance plans

Parameters |

ULIP |

Mutual Fund |

Traditional Insurance |

Purpose ULIP vs Mutual Funds vs Traditional Life Insurance |

ULIP is a hybrid instrument which provides both Insurance coverage along with investment benefits. | Mutual Fund provides Investment benefits only. | Traditional Insurance Plan provides Insurance cover only. |

Regulatory Body ULIP vs Mutual Funds vs Traditional Life Insurance |

Insurance Regulatory and Development Authority of India | Securities and Exchange Board of India | Insurance Regulatory and Development Authority of India |

Return on Investment ULIP vs Mutual Funds vs Traditional Life Insurance |

ULIP is linked to the market and the market is volatile so the returns are variable. The returns in a ULIP are comparatively low compared to Mutual Funds, due to high Insurance Charges (“Premium Allocation Charges”) and better |

It provides variable returns as the investment is linked to equity. The returns in Mutual funds are higher than those In ULIP or traditional Insurance Plan. But it doesn’t come with life insurance coverage. | It provides guaranteed and non-guaranteed returns (dependent on Bonuses declared by the Insurance Company for policy holders) as described in the insurance policy. Since, it is a product with low returns and high risk cover, it is mostly advised to be opted for Guaranteed Returns in case of these plans. |

When should you Consider ULIP vs Mutual Funds vs Traditional Life Insurance |

You may consider ULIP if you seek protection and better than nominal returns in long-term plans. | You may consider Mutual Fund when you want high returns in a long term. | It will be a good option when you want protection from an unfortunate mishap in the future. The objective to buy this plan is only to indemnify from the loss caused to the uncertain event in the future rather than earn a huge amount of returns. |

How your money is utilized ULIP vs Mutual Funds vs Traditional Life Insurance |

The money that is paid in form of a premium is utilized in expenses for running the fund like salary to the portfolio managers/ research expenses, infrastructure costs etc, insurance Cover, and investing in equity mutual funds. | The money invested in a mutual fund is utilized for expenses and buying of either equity or debt instruments or both. | The money that is paid in form of a premium is utilized for expenses, insurance cover, and low-risk instruments like bonds or government schemes. |

Flexibility ULIP vs Mutual Funds vs Traditional Life Insurance |

There is flexibility in terms of where or which type of fund allocation you want to do in ULIPs. For example, Blue chip funds or balanced funds or hybrids. | You have the option to switch the type of mutual fund you want to invest. However, you have to pay exit load if you redeem the units before the specified period. Also you can not withdraw funds from a locked-in equity linked savings scheme (ELSS). | It offers No flexibility. |

Tax Benefits in investment ULIP vs Mutual Funds vs Traditional Life Insurance |

Tax benefit Is available under Section 80C. | The investment in Mutual funds does not come under the ambit of tax benefits under section 80C of the Income Tax Act except ELSS. In ELSS the money that you have invested will be utilized to buy only equity. | Tax benefit Is available under Section 80C. |

Tax Benefits on Returns ULIP vs Mutual Funds vs Traditional Life Insurance |

The proceeds from a ULIP are exempt u/s 10(10D) of Income Tax Act, in case of Annual Premium under a ULIP plan is less than or equal to Rs. 2.5 Lakh Per annum per PAN card holder. | Equity Mutual Funds are taxed at 10% and 15% tax rate for LTCG and STCG respectively. For more details, refer our article on FD vs Mutual Funds – for complete taxation of Mutual Funds. | The proceeds from a Traditional Life Insurance Policy or Endowment Plan are fully exempt under section 10 (10D) of Income Tax Act, 1961. |

Expense ULIP vs Mutual Funds vs Traditional Life Insurance |

The expenses to manage ULIP are high. | The expenses to manage mutual funds are low. | The expenses to manage Traditional insurance plans are high. |

Investment Portfolio ULIP vs Mutual Funds vs Traditional Life Insurance |

The money invested in ULIP will be utilized to buy stocks of different companies. Portfolios are actively managed by the Portfolio managers but a ULIP holder will never get to know the exact holding at any point of time until and unless insurance company is declaring its holdings. | The investment portfolio is declared in Mutual funds on a quarterly basis and the NAV can be tracked on daily basis. | No transparency and the investment portfolio remain unknown to the policyholder. |

The Lock-in period ULIP vs Mutual Funds vs Traditional Life Insurance |

Lock-in period is a minimum of 3 – 5 years | Mutual Funds has no lock in period. However, ELSS mutual funds which offers tax benefits under section 80C,are locked in 3 years. | The Traditional insurance plan is locked in till the maturity of the plan. |

Security ULIP vs Mutual Funds vs Traditional Life Insurance |

ULIP provides no security | Mutual Fund provides no security | Traditional Insurance plans are highly secured. |

Switching options ULIP vs Mutual Funds vs Traditional Life Insurance |

It allows you to switch between the assets linked to the plan. | The switching option is not available. You can only exit from the fund if you want to. | The switching option is not available. |

Ideal term ULIP vs Mutual Funds vs Traditional Life Insurance |

Stay invested for a medium to long term | There are different funds for long and short term duration | Suited for long term investment |

Thanks for reading this article. Hope you found it very insightful and eye opener.

For more such blogs, visit Bharatpaisa.com

Please comment your questions and feedback below.