Contents

What is Term Plan?

Term Plan / Term Life Insurance – simply put is a life insurance for a fixed term / period. Term Life Insurance is the cheapest form of insurance that one can buy to protect his loved ones and family. Now, the next question in your mind is whether you should buy a term plan and is it really worth it?

Why should you buy a term plan?

Who knows, what is in the store of our destiny? Uncertainties are there ready to take place at every next moment of our lives. But we plan for every single step in the future to make the future secure for us as well as our family. Now, the point is whether you should really buy it?

To answer this, let’s consider that you have a Currency printing machine at home that prints and gives you currency every month, would you insure this machine from theft, damage, fire, etc. etc. YES… Of Course Yes. And that machine is you my dear. You earn money for your family needs every month. And Term Plan does this exactly for you in case of your unfortunate death. We are here to hand over the needed information to you regarding the term life insurance.

Why are term plan a must buy?

Term Plans are a must buy because of the multiple reasons briefly listed below:

- Death is unavoidable and inevitable

- You have dependents who depend on you for their livelihood

- You do not expect Government or Friends & family to take care of your family after you are gone – like the way you care for them

- Your peace of mind is priceless and so is your family’s happiness

For easy understanding in Hindi, click on this youtube video link just below:

Benefits of buying a Term Life Insurance

Although the biggest benefit of buying a term life insurance cover is to protect your loved ones from the financial loss arising out of your death, there are certain other benefits of it, which are mentioned below:

Low Premium

A term plan provides you with the highest death benefit or life cover for just a nominal premium. The term plan premium is lower than all other Life insurance plans. You should know well that it provides only a life protection plan. No ancillary benefits or investment element is attached with it.

Benefits of starting early

The term plan premium you pay for the term plan depends on your age and the policy term. If you buy a term plan at an earlier age, you will have to pay a comparatively lower premium, which shall remain fixed for the whole policy term and any increase in future premiums will not affect your premium

Income Tax Benefits

Concerning the premium paid, you can avail of a deduction of up to Rs 150,000 per annum as per reference to Section 80C of the Income Tax Act 1961. Also, the death benefit that is paid to your nominee is tax-free under Section 10 D of the Income Tax Act 1961. However, that all rings true only under unfortunate death.

Peace of mind

Peace…. Shanti… is very difficult and rare now a days. And you surely don’t want your family to be left depending on your friends and family and government to feed them and take care of them, to pay for your children education, in your absence. When buying a term plan, a sufficient life insurance cover will safeguard your family’s future after you and help them live a life of dignity even when you are not around.

Pay off debts

With adequate coverage, you can also safeguard your family against any loans that you had taken earlier and are remaining unpaid when you left this world. Life Insurance Benefit on death, can come to your family’s rescue in times of need.

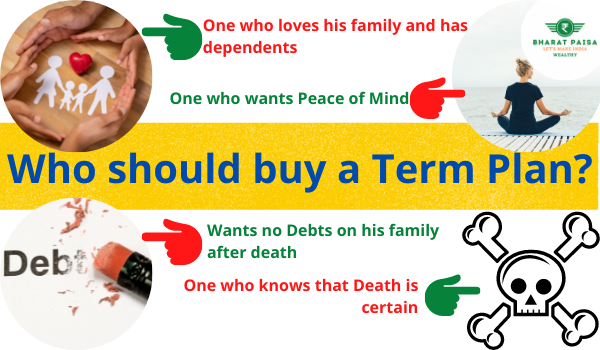

Who should buy a term plan?

Everyone who has dependents who depend on his / her income for their survival, should buy a term plan. Everyone is good to go with a term plan without any if and but. However, there are specific needs of having term plans as per your age. Let’s have a look over!

● If you are in your early 20s, you will have to pay a lower premium for a term life insurance.

● If you are in your 30s and 40s, you most probably are married with multiple responsibilities, so a term plan may reduce your worries.

● In your late 40s and 50s, you may have grand commitments with your goal and family, so a term life insurance plan with adequate coverage will be no less than a boon.

● Now, it’s time for your enjoyment after the 50s. However, if you still wish to bless your family with something, a term plan is well on the way for you but with a higher premium.

Who shouldn’t buy a term plan?

Enough has been said and explained about the need and benefits of term life insurance, but a coin has two sides. Let’s know, who doesn’t need a term plan?

- A person who has no Income

- A person who has no dependents on his income

Now, if you fall in any of the above two category, then surely buying a term life insurance is no worth to you since without sufficient income, you won’t be eligible to buy it and without dependents to protect or care for, for whose benefit are you buying a life insurance cover?

Conclusion

A careful reading and understanding of this article would have given you a clear idea about whether you should buy it or not.

Now, in our next article, we will cover the benefits of buying a term plan early in life and also How to choose the best one for your family, things to consider before buying the most suitable plan.

So keep visiting Bharatpaisa.com for more such useful blogs on personal finance and wealth building.

Please share this blog with people whom you love and know that they love their family so much to take care of them.

Until next blog, Keep sharing love and knowledge. 🙂